There are tons of reasons you may wish to carry out a Reverse EIN lookup tool. Perhaps, you want to look up your EIN for tax purposes. Or are you trying to find out more information about another business? Fortunately, there are many reverse EIN number lookup tools and techniques. But they aren’t all created equally. In this guide, we will share all the effective ways to look up an EIN and the information you can find.

What Is an EIN?

EIN or Employer Identification Number is a unique nine-digit number assigned to businesses to enable the IRS to identify them. It is also called the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number (FTIN). It works like the Social Security number, but in this case, it is given to employers. And your business needs the EIN, whether you have one or a million employees.

Before 2001, you could identify where a business was located by the first two digits of the EIN. But after that, assigning EINs became more centralized, making this more challenging. That said, most businesses feature their EIN on their website, brochures, and other assets.

What Is an EIN Used for?

At the foundation, you cannot run a business without having an EIN. The EIN plays many vital roles for your business towards the U.S tax and regulatory frameworks categorized into four areas:

- Federal Tax Filing: The IRN uses the EIN to identify businesses for tax reporting or otherwise to identify taxpayers required to file diverse business tax returns. So, the EIN enables businesses to report their income, deductions, and financial details accurately. Furthermore, it helps keep your personal finances separate from your business ones. With your EIN, you can avoid costly errors and compliance issues with federal tax laws.

- Facilitates Partnerships and Corporations: You need an EIN to pick your business structure (e.g., partnerships, non-profits, S Corporation, Corporation, or LLC). It’s even necessary for certain organizations like estates or trusts. The EIN facilitates forming partnerships with others, thereby allowing entities to establish their own distinct identities different from individual partners and shareholders. And in that regard, it ensures your business can handle its complex tax obligations effectively.

- Regulatory Compliance: The EIN helps businesses meet their various regulatory requirements with the federal and state authorities. This cut across being able to pay employees, get licenses and permits, and many more. It also serves as the anchor for other government agencies to track and verify your business’s compliance with regulations.

- Operations: Businesses also need the EIN to open corporate accounts with financial institutions like credit unions, banks, and brokerage houses. Without it, there’s no way to verify your legal status and facilitate opening bank accounts, applying for loans, and insurance underwriting.

What Is Reverse EIN Lookup?

When you want to perform a reverse EIN lookup, it means you know the 9-digit EIN number of that company and want to find out more about it. Unlike the Social Security number, the EIN is not considered sensitive information. This means you can carry out a reverse EIN lookup freely without worrying about breaking any laws.

Why Perform a Reverse EIN Lookup?

Performing reverse EIN number lookups helps you confirm the legitimacy of a business or gather information about a potential business partner or client before entering into a transaction. It can also help you detect fraudulent activities or businesses and identify risks associated with that business, such as legal problems or financial instabilities.

To sum up, the key benefits of performing a reverse EIN lookup are:

Verify Business Legitimacy

A reverse EIN lookup helps confirm if a company is legally registered with the IRS. This prevents fraud or partnerships with shell companies. For example, cross-checking a vendor’s EIN with IRS records ensures they’re authorized to operate.

Streamline Due Diligence

Businesses use reverse EIN searches to uncover tax liens, compliance issues, or ownership history before mergers, investments, or contracts. Tools like Middesk provide detailed reports linked to an EIN, saving time on background checks.

Access Critical Business Details

By searching an EIN, you can retrieve registration addresses, business structures (LLC, Corporation), or historical name changes. This is vital for tracking subsidiaries or validating a company’s physical location.

Simplify Financial Transactions

Banks and lenders often require an EIN to open business accounts or approve loans. A reverse lookup ensures accuracy when submitting financial forms like 1099s, avoiding IRS penalties for mismatched data.

Ensure Regulatory Compliance

Verify EINs for contractors or nonprofits (e.g., using CharityCheck101) to meet IRS reporting rules. For instance, confirming a charity’s 501(c)(3) status ensures tax-deductible donations comply with federal guidelines.

Enhance Market Research

Analyze competitors or industry trends by linking EINs to public SEC filings or annual reports. Investors use this to study a company’s financial health or uncover parent-subsidiary relationships.

What Information Can I Get By Using Reverse EIN Lookup?

As said earlier, performing a Reverse EIN lookup allows you to uncover complete information about any company. Depending on the Reverse EIN number lookup tool you choose, you can find data like:

- EIN registration details: when the business was registered with the IRS.

- Type of business: for example, LLC, corporation or sole proprietorship.

- Business contact: including business phone numbers.

- UBO (Ultimate Beneficial Owner): This includes the names and positions of key stakeholders, business licenses and permits.

- Tax details: filing status and tax period.

- Financial information: including bankruptcy data, annual and quarterly reports, if available.

- Judgments: Any liens and litigations.

- Status: Active, inactive or revoked business.

How to Perform a Reverse EIN Lookup in 2025

The right reverse EIN lookup tool depends on the information you want to find. Here, we’ve put together a list of some of the most effective Reverse EIN number lookup tools, how to use them, and the information you’ll find.

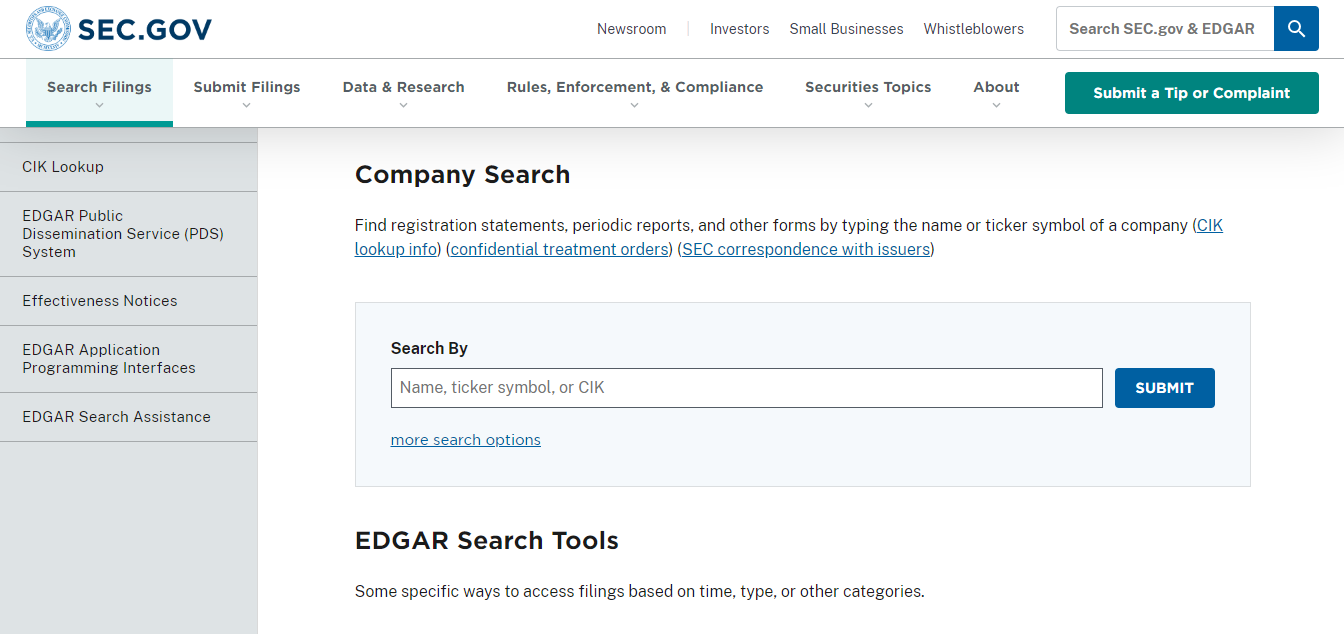

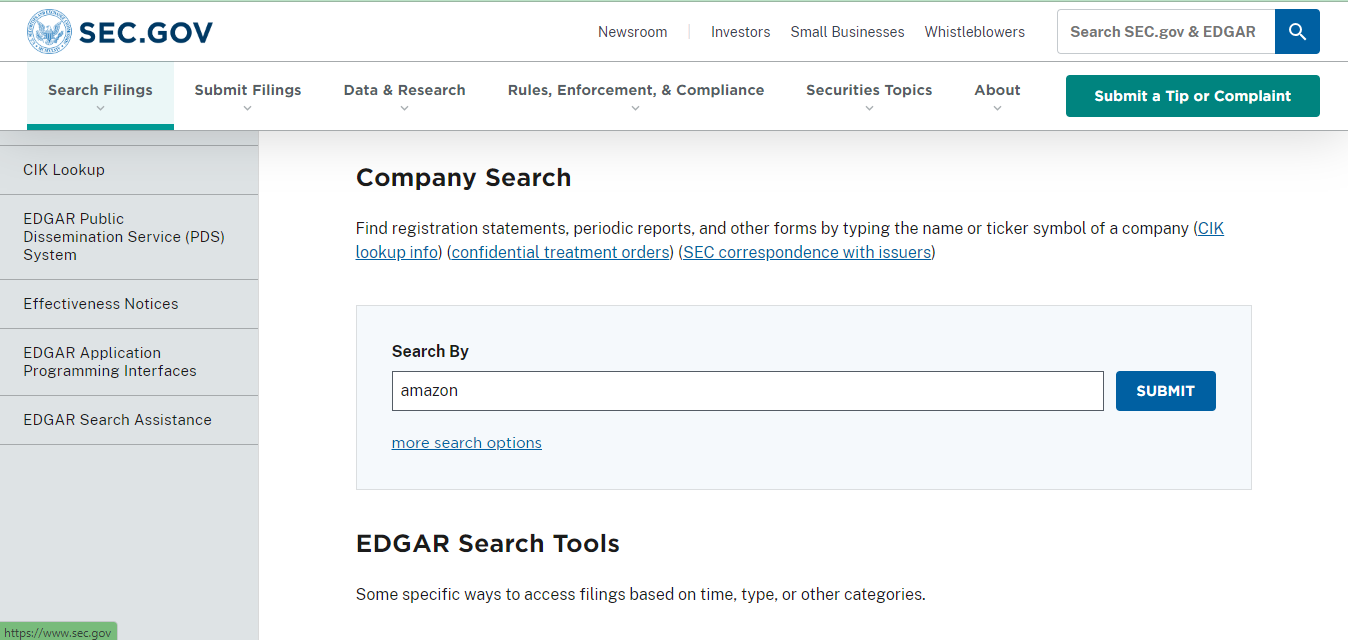

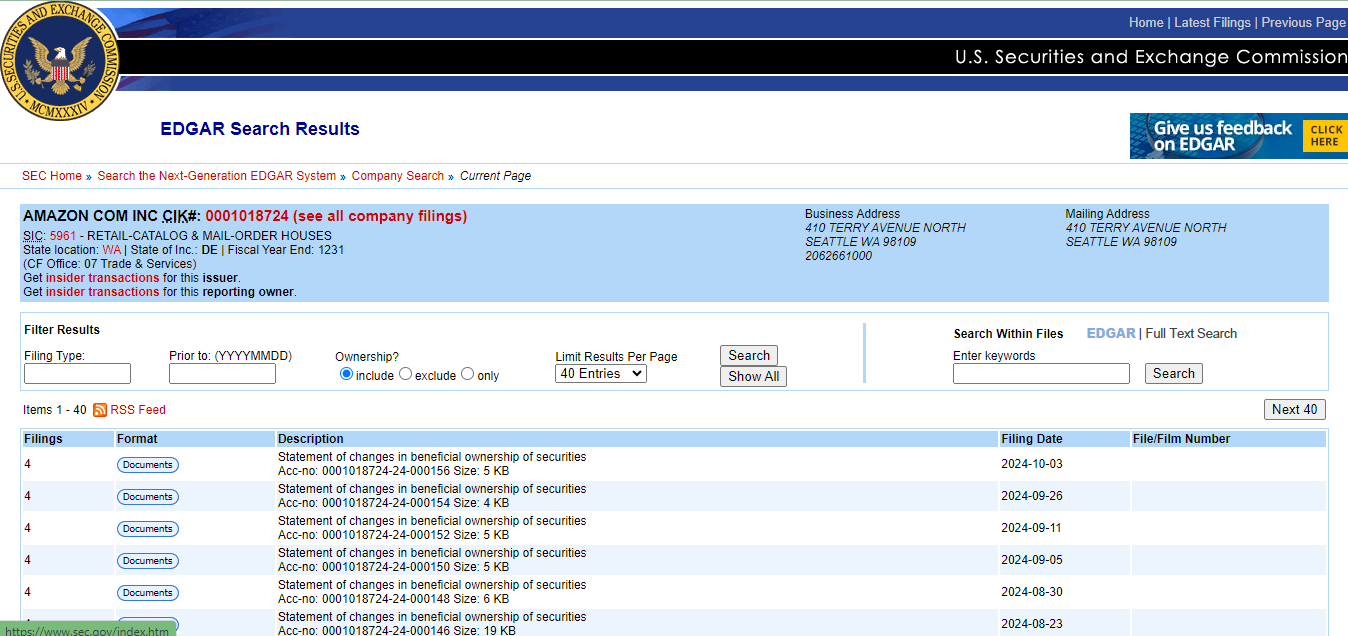

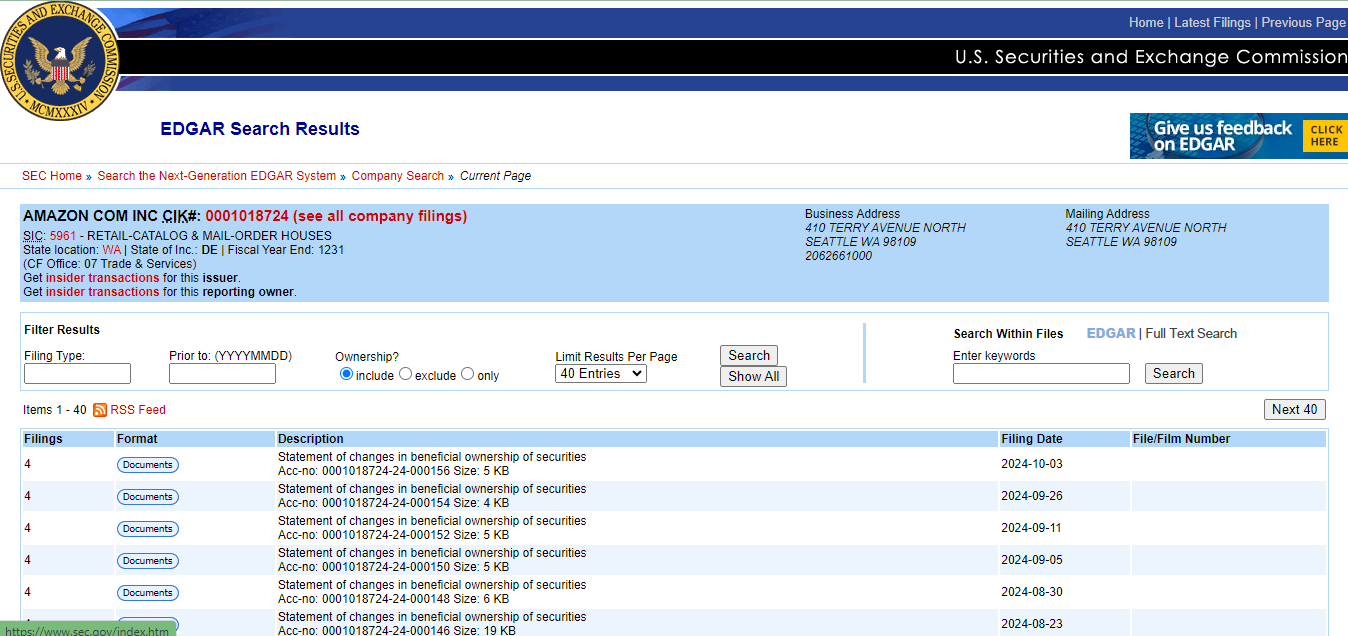

SEC

One of the best ways to reverse an EIN lookup for free is by using the SEC search filings page. Here you’ll find tons of information about publicly traded companies. You can view their EIN registration documents, real-time filings, periodic reports, and financial statements. The SEC page is, however, limited to publicly traded companies.

👉Here’s how to use it:

- Go to the SEC Search filings website

- Enter the company’s name, EIN number, or ticker symbol

- Tap “Submit”

- Scan the results and pick the right company

- Pick the document you’re looking for

💰Pricing: Free

Middesk

Middesk offers fantastic business verification services, including an EIN reverse lookup tool. Here, you can quickly verify the legitimacy of any business and avoid working with fraudulent companies. On this website, you’ll find robust details about any business, including the correct business name, address, phone number, bankruptcy data, litigations, liens, industry classification, watchlist, and more. Nevertheless, Middesk is best used by businesses and not personal checks because it can get very expensive. To use Middesk:

- Go to the Middesk website. Tap “Talk to sales”

- Fill in the details about your own business.

- A sales rep will contact you about the price system that works for you and onboard you on using the platform.

💰Pricing: varies per company

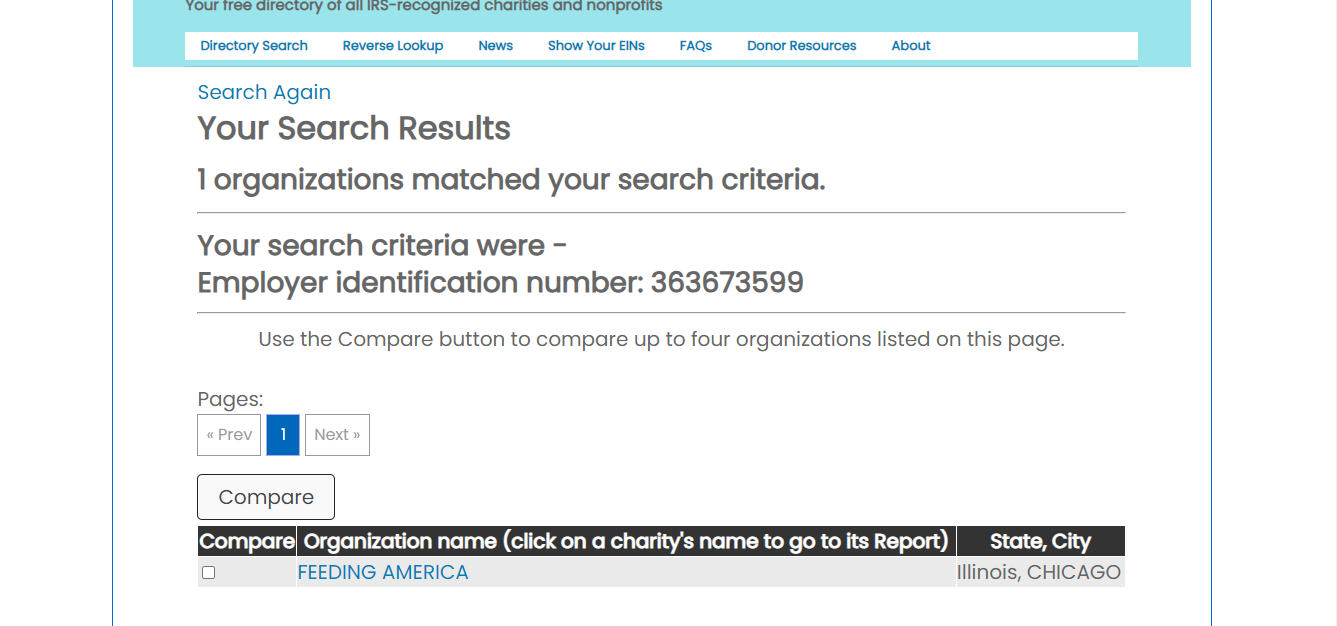

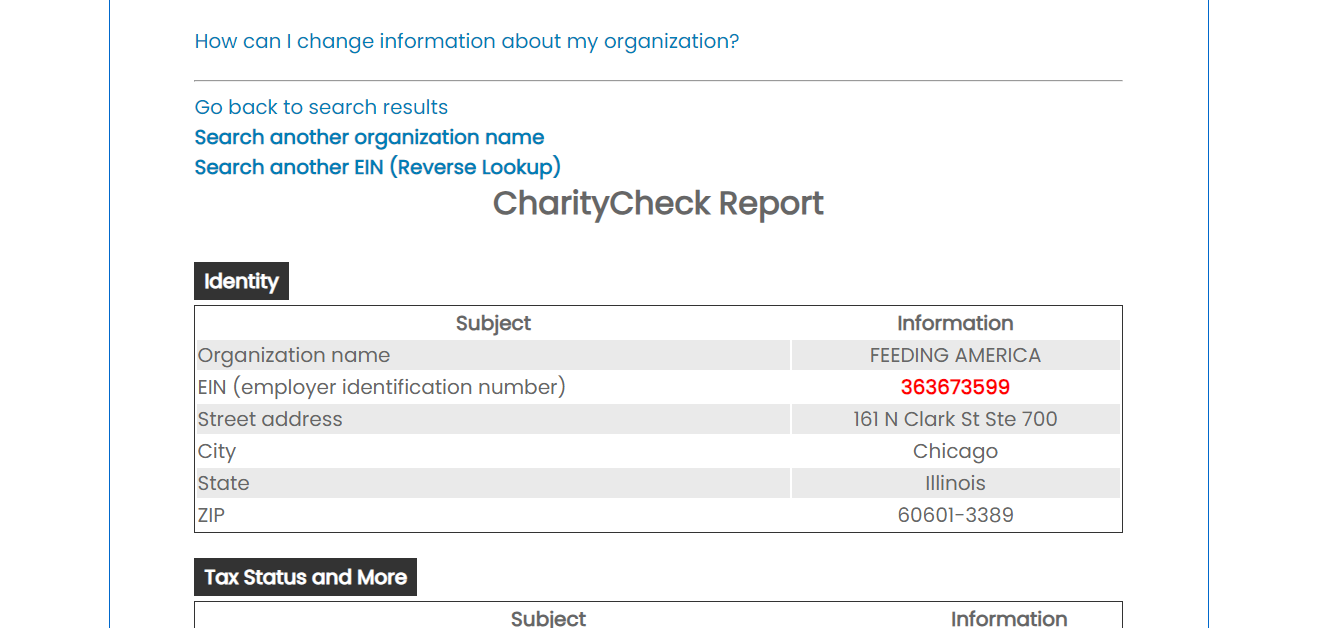

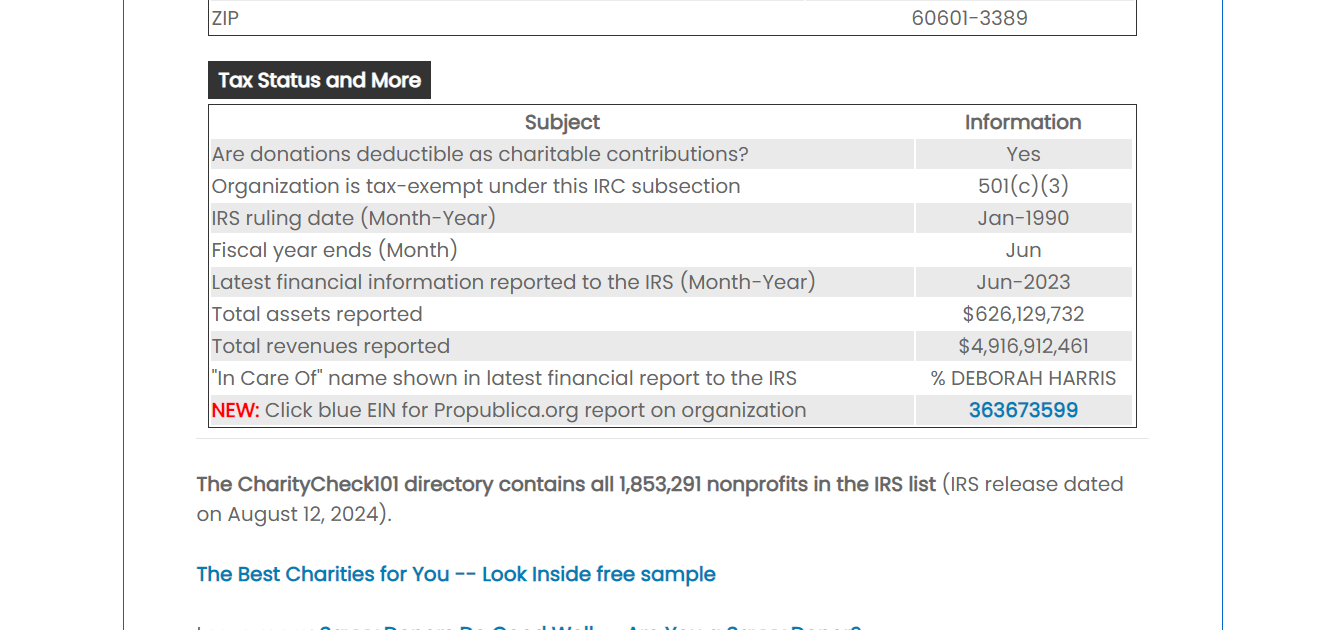

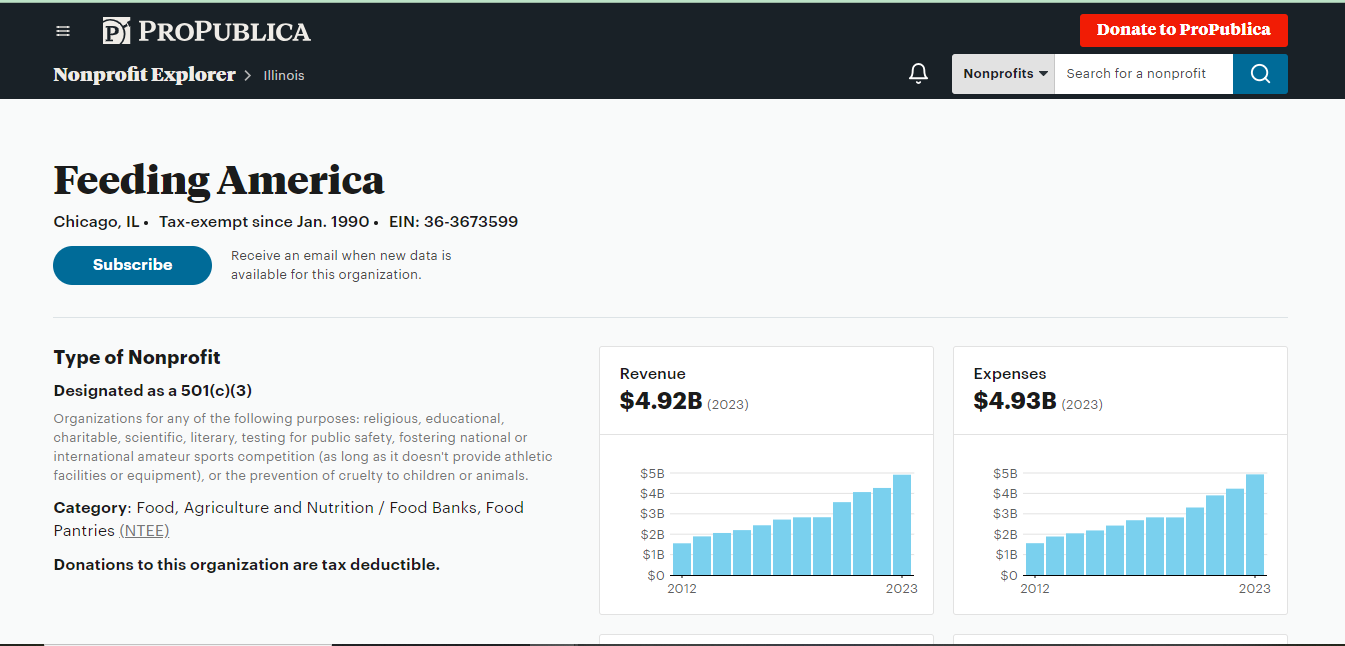

CharityCheck101

CharityCheck is a fantastic reverse EIN lookup tool that allows you to check on any charity or non-profit business in the U.S. CharityCheck also allows you to uncover their tax status, financial information, and if they’ve received any warning from the FBI, IRS, FTX or NASCO. It’s a fantastic platform for verifying whether you’re dealing with a reputable charity organization or a scam. To use this:

- Go to CharityCheck EIN lookup.

- Scroll down and type in their EIN number (without the hyphen). Select “search”

- Pick the charity that matches your search to view a summary about it.

- Read through the summary

- For a more detailed report, tap on the blue highlighted EIN number.

- This redirects to the ProPublica website, where you can view other details.

💰Pricing: Free

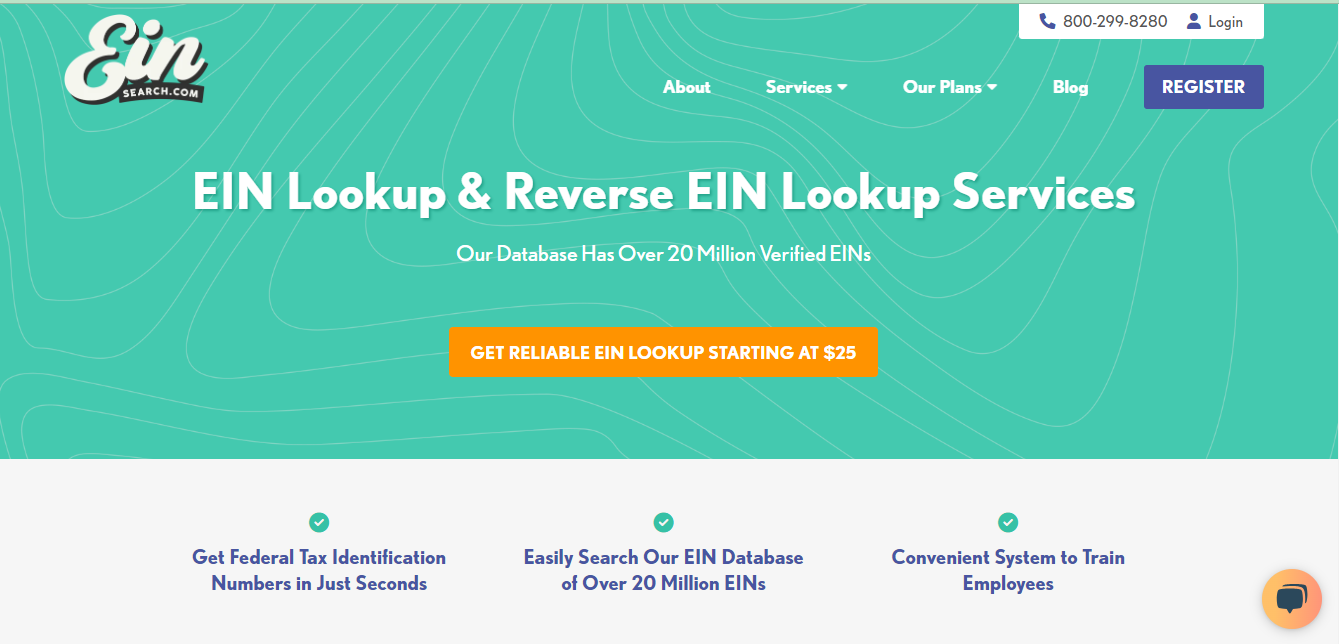

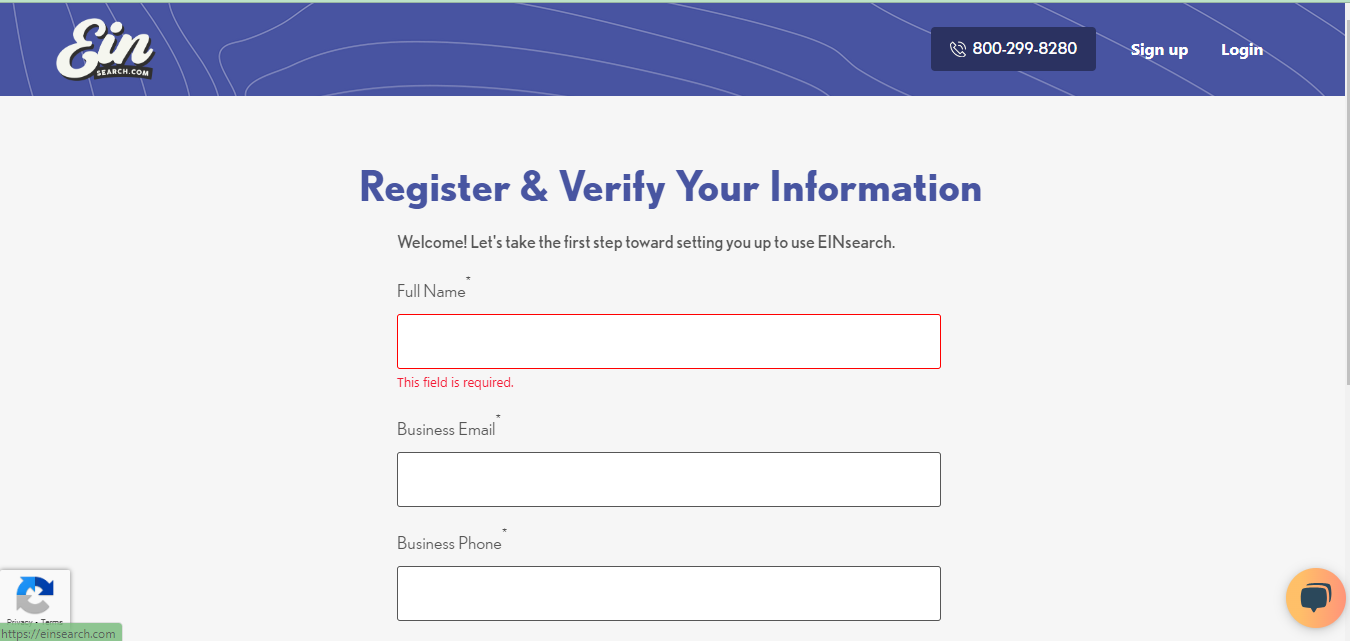

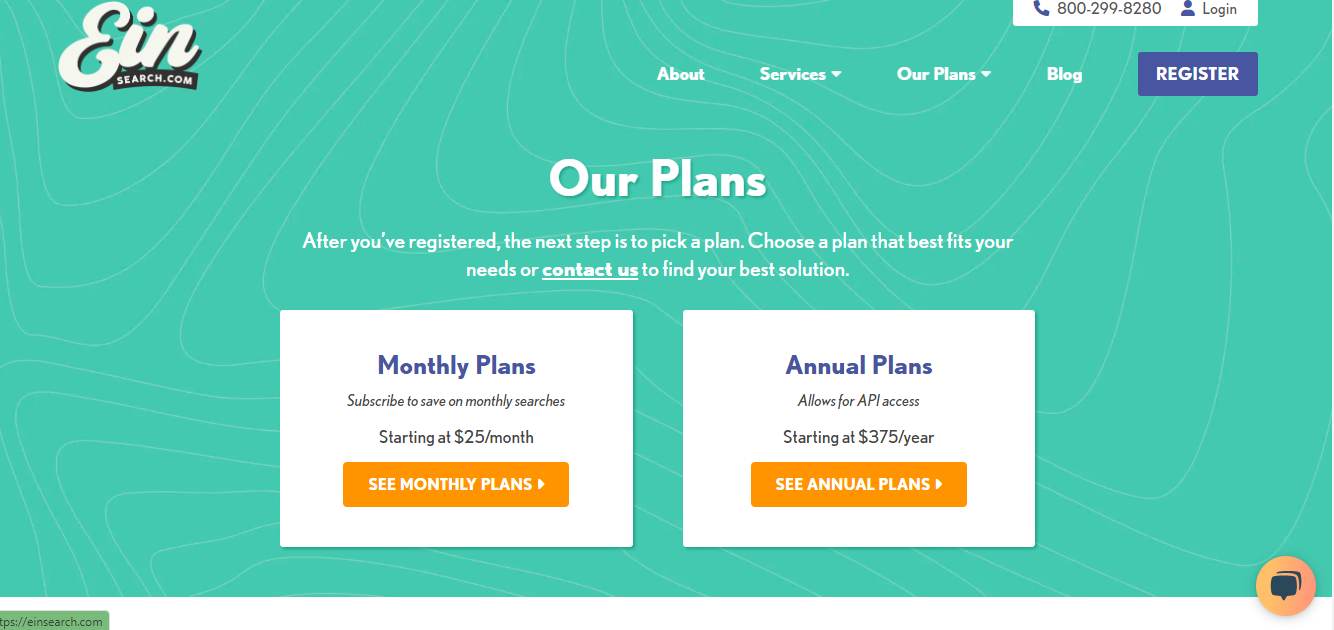

EINSearch

EINSearch is also a fantastic reverse EIN number lookup tool with access to over 20 million verified EINs through its direct connection with the IRS. Here, you’ll find details about those companies, payroll details, IRS status, financial statements, tax status, and more. They are perfect for verifying the legitimacy of any business.

- Go to EINSearch and tap “Register.”

- Enter your details and select a payment plan

- Start looking up any EIN by entering the EIN number.

💰Pricing: Starts from $40 per month.

A Quick Comparison of Reverse EIN Lookup Tools 2025

| Tool | Features | Price | Data Coverage | Best For |

|---|---|---|---|---|

| SEC Filings | Public company EINs, financial statements, real-time filings, registration docs. | Free | SEC-registered public companies only. | Investors, Researchers, Public company analysis |

| Middesk | Business verification, bankruptcy/litigation records, and industry classification. | Custom pricing | U.S. businesses (private & public), IRS liens, state business registries. | Business Owners, Compliance Teams, High-Risk Supplier Reviews |

| CharityCheck101 | Nonprofit tax status, IRS/FBI warnings, financial transparency reports. | Free | IRS-recognized 501(c)(3) charities and nonprofits. | Non-profit organization, Donor, Charity event organizer |

| EINSearch | Payroll data, tax status, IRS compliance checks, 20M+ verified EINs. | From $40/month | Direct IRS partnerships + state-level business data. | Accountants, financial institutions, and companies that require in-depth tax audits |

Additional Tips on How to Find Your & Other Companies’ EINs

What if you don’t know your EIN number or want to find another company’s EIN? Here are some tips that can help.

- Check your EIN confirmation letter: Depending on what you chose during your EIN application, you may have received your EIN via your physical mail, e-mail or even online (and stored on your computer).

- Check your tax documents: For your own business, you can check your federal tax returns like Form 8871, 8872, 990, 1040EZ, 1120, or 1040. You can also check the W-2 forms issued to your employees, which should include your EIN.

- Evaluate the 1099 forms: If you are a contractor working with another business, you’ll find their EIN on the 1099 form they issued to you.

- Check your documents: Business bank statements, credit reports, loan applications, insurance policies, and business license application/renewal documents often contain the EIN. Note that other documents, like your DBA or Articles of Incorporation documents, will not list your EIN.

- Use the IRS hotline: You can also ask the IRS directly about your own business EIN at 1-800-829-4933 between the hours of 7 am and 7 pm, Monday through Friday. Keep in mind that the IRS will need you to prove you are a qualified owner of the EIN.

- Access the Secretary of State’s records: States often maintain public records of businesses. If you know where the business is situated (or its headquarters), you can search there for the company’s registration information.

- Check the business website and media: Some businesses list their EIN number on their website, brochures, social media pages, and other media assets.

FAQ

How to find the business name and address without an EIN?

If you only have a phone number but no EIN for a business, you can still find the correct name and address of that business. This often comes in handy when you’ve received calls from a brand and want to make sure the phone number is connected to that business (and not a scammer). You can use MLocator’s reverse phone number lookup tool. Simply enter that phone number on the MLocator reverse phone lookup page, and it will find the address through a phone number.

Is there a free database for EIN lookup?

The SEC’s EDGAR database is a free way to look up the EIN number of any publicly traded company in the U.S. This fantastic website will find their financial documents, tax documents, annual and quarterly reports, statements of beneficial ownership for officers, directors, and owners, reports on mergers, acquisitions or changes in management and more.

Is EIN public information?

Yes, the EIN is public information and is freely distributed by businesses on their website and other publications. Using the EIN, you can look up information like the business name, address, industry, ownership structure, the company’s financial performance, phone number, website, and even reviews.

Final Thoughts

Carrying out a Reverse EIN lookup comes in handy on many occasions. Whether you want to look up the financial and tax standings of a company or want to verify scams, the EIN is a handy tool. Here, we’ve talked about the best Reverse EIN lookup tools, including free and paid solutions. Feel free to try them out. And when all else fails, you can always reverse phone lookup with MLocator to verify any business.